UP COLLEGE OF LAW

UP COLLEGE OF LAW

ISO Certification

We are pleased to announce that following rigid training in quality management system over several months, the UP LAW Complex (UP College of Law and UP Law Center) successfully hurdled the 3rd party audit in October and November 2020 for ISO 9001:2015 certification. The UP LAW Complex, consisting of 20 institutes, divisions, and units, was evaluated and found compliant with the standards “with no NCs (nonconformities).” It is officially recommended and recognized as an ISO 9001:2015 certified organization and will receive its certificate in the coming weeks following usual protocol.

The UP Law Complex reaffirms its commitment to quality service and the highest standards of excellence in its teaching, research, and extension services.

UP IHR holds a public forum on Anti-Rape Laws in the Philippines

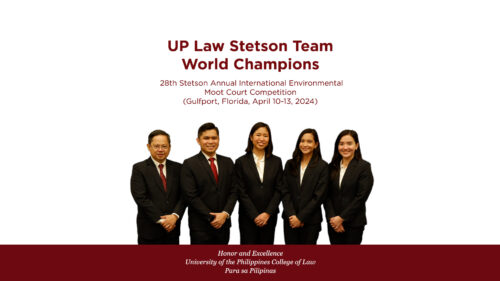

UP LAW Bags Championship at 2024 Stetson Annual International Environmental Moot Court Competition

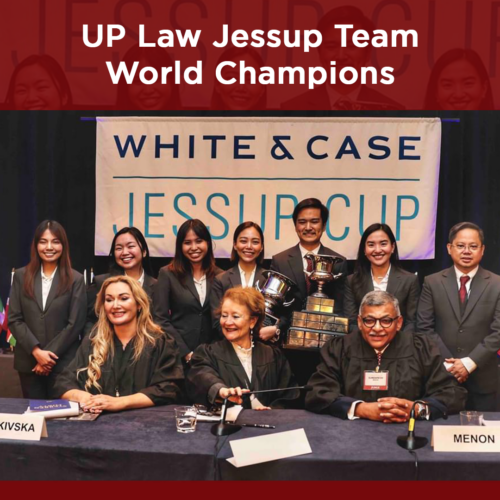

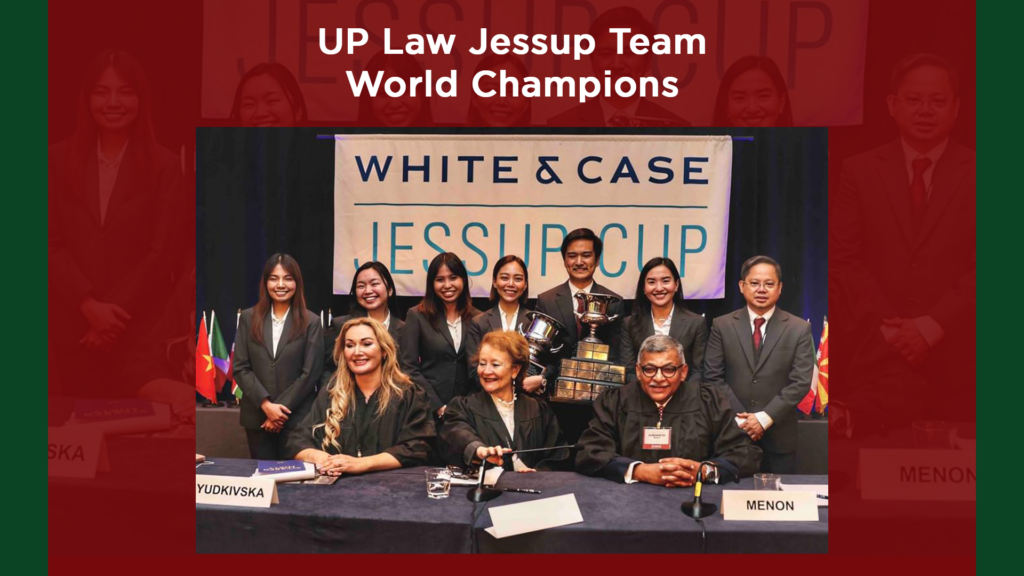

UP Law Prevailed as World Champions of 2024 JESSUP Moot Court Competition

Clearing a Path for an Anti-Discrimination Law

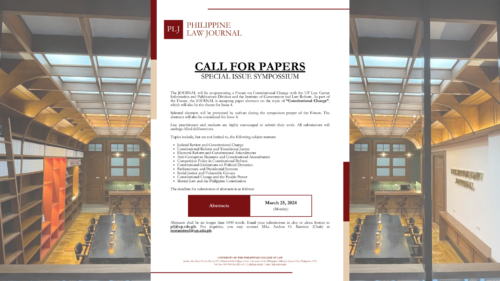

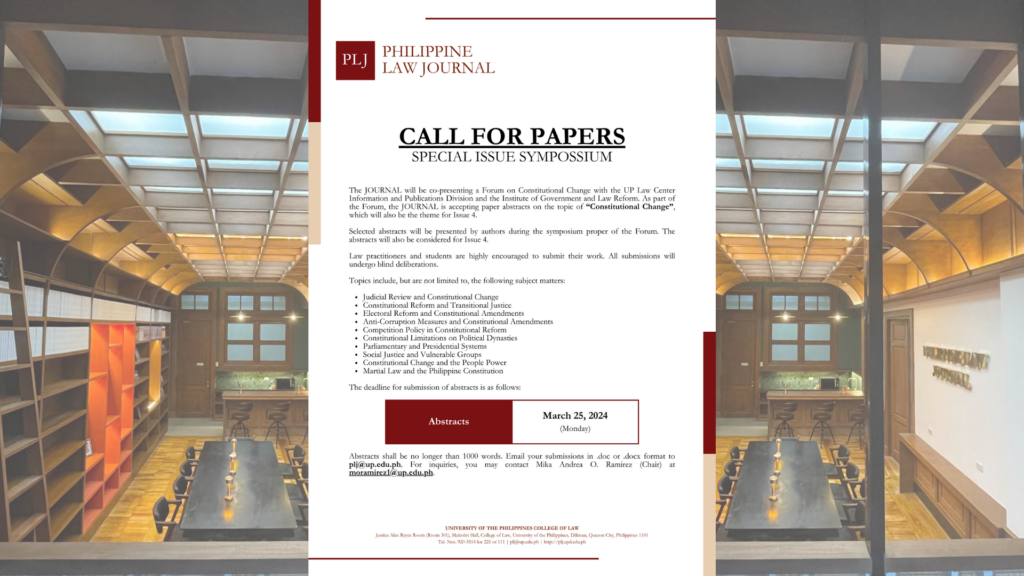

PLJ Vol 97 Call for Abstracts: Special Issue Symposium

Assessing and Advancing Anti-Rape Laws in the Philippines

May It Please the Court 2 Tips for Law Enforcement

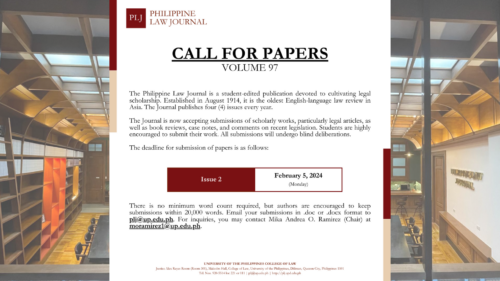

PLJ Volume 97 Extended Call for Papers

Gratitude to the Donors of the UP College of Law Scholarship

Call for Scholarship Applications for the 2nd Semester A.Y. 2023-2024

UP IHR holds a public forum on Anti-Rape Laws in the Philippines

UP LAW Bags Championship at 2024 Stetson Annual International Environmental Moot Court Competition

UP Law Prevailed as World Champions of 2024 JESSUP Moot Court Competition

Clearing a Path for an Anti-Discrimination Law

PLJ Vol 97 Call for Abstracts: Special Issue Symposium

Assessing and Advancing Anti-Rape Laws in the Philippines

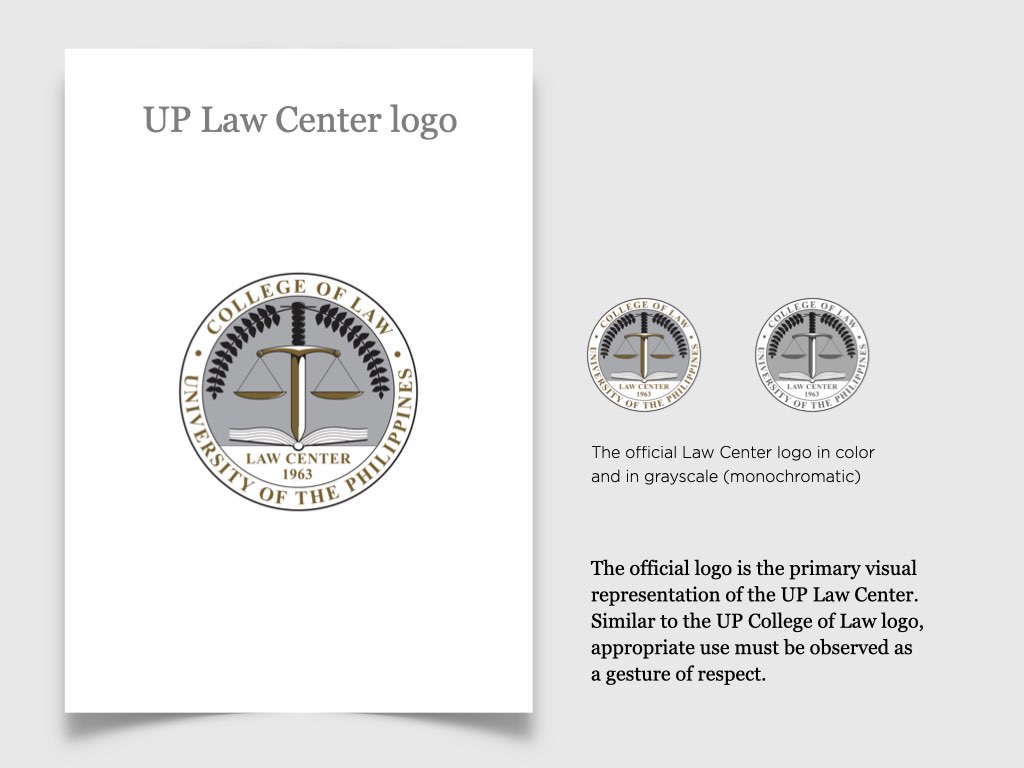

ISO 9001:2015

The UP Law Complex operates a management system that conforms to the standards of ISO. Use the QR code to view the certification. Tap or hover on this box to know more.

_What is an ISO certification?

ISO Standards are internationally agreed by experts. It is the world's best-known quality management standard for companies and organizations of any size.

Receive Updates

ISO 9001:2015

The UP Law Complex operates a management system that conforms to the standards of ISO. Use the QR code to view the certification. Tap or hover on this box to know more.

_What is an ISO certification?

ISO Standards are internationally agreed by experts. It is the world's best-known quality management standard for companies and organizations of any size.

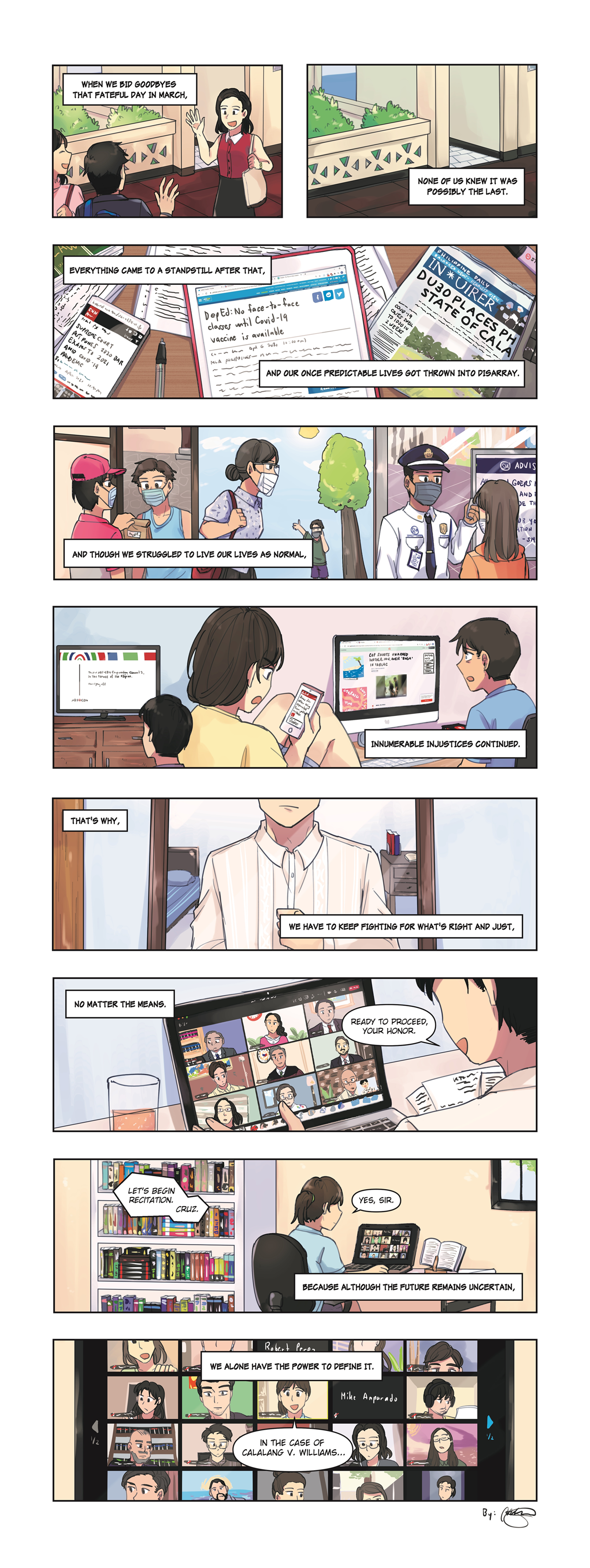

COVID-19 RESPONSE

There is nothing more important at this time than ensuring the health and safety of our faculty, students and staff. Hence, all face-to-face and online classes of UP Law have been suspended (view the Memorandum No. FCT 2020-019 of Dean Fides Cordero-Tan) in accordance with the announcement of Chancellor Fidel R. Nemenzo. All students must stay at home until further notice.

Professors and students are encouraged to keep in touch online for assignments or other instructions for self-directed learning. Staff may refer to the UP Diliman announcement regarding essential duties. Please refer to our COVID-19 Response webpage for announcements, issuances, and resources. We also provide online legal aid via #UPLawHelps.

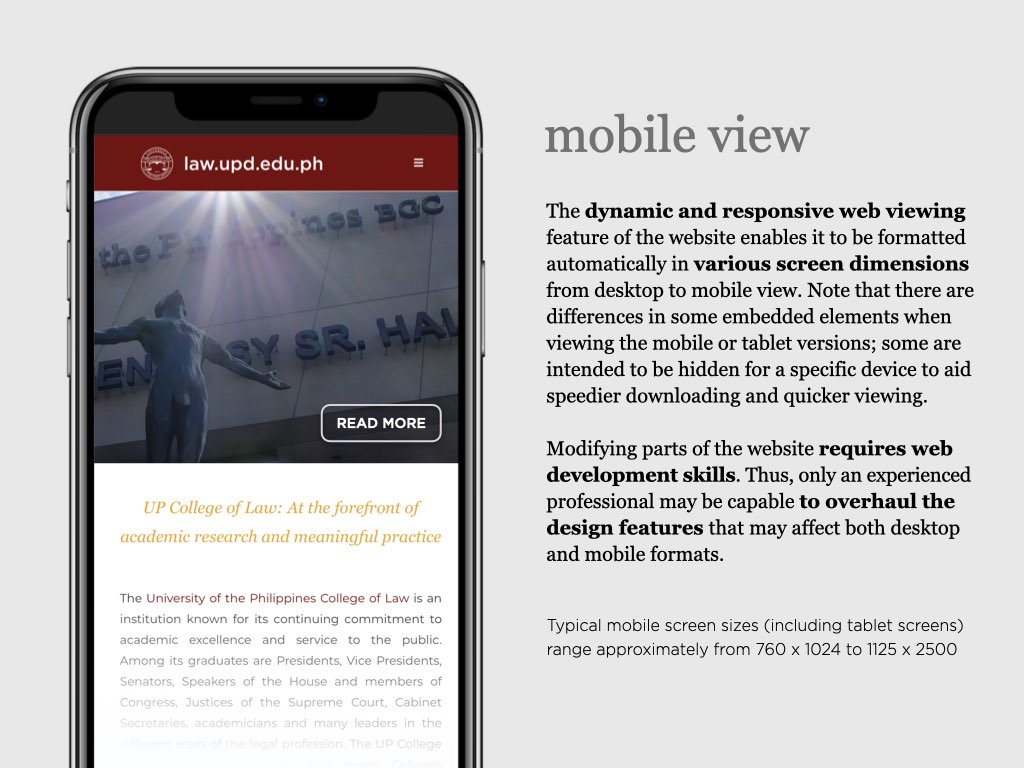

UP College of Law: At the forefront of academic research and meaningful practice

The University of the Philippines College of Law is an institution known for its continuing commitment to academic excellence and service to the public. Among its graduates are Presidents, Vice Presidents, Senators, Speakers of the House and members of Congress, Justices of the Supreme Court, Cabinet Secretaries, academicians and many leaders in the different areas of the legal profession. UP Law was among the first seven Colleges established after the foundation of the University of the Philippines on June 18, 1908. Since then, the College transformed from a professional school offering a degree program, to a Law Complex with a triad of functions: 1) instruction, 2) research, and 3) extension service.

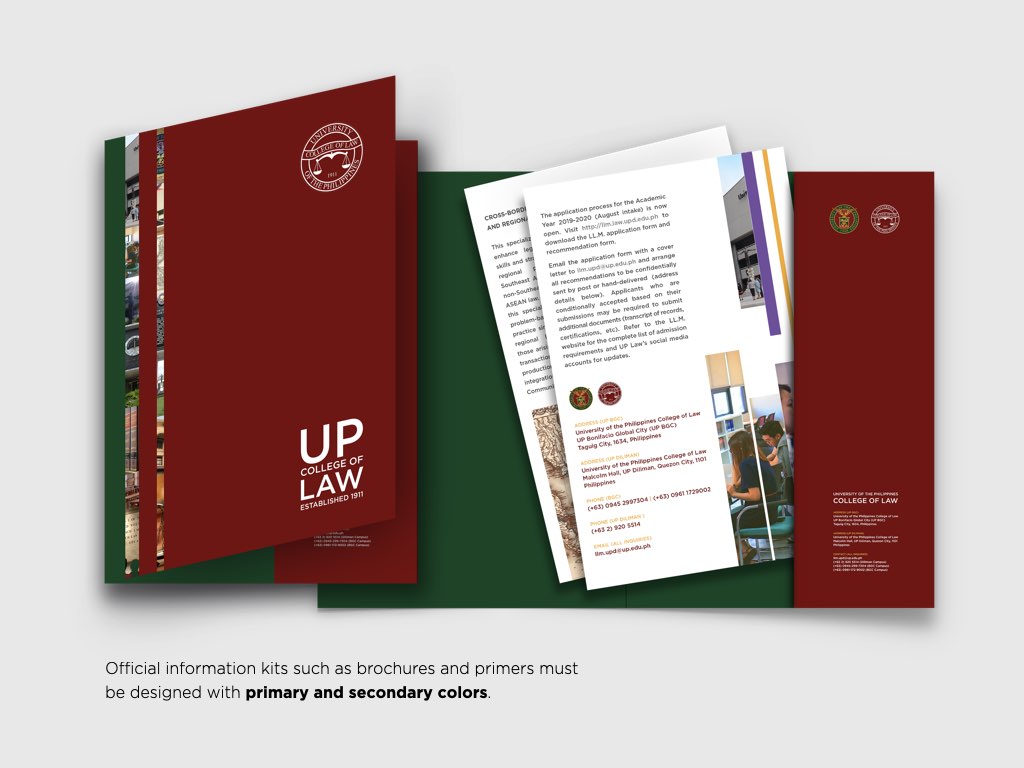

For more information, download our brochure here.

UP COLLEGE OF LAW PROGRAMS

The University of the Philippines offers the following degree programs administered by the College of Law in Diliman and Bonifacio Global City:

- Four-year program leading to a Juris Doctor (J.D.) degree

- Five-year program (minimum) for working and part-time students leading to a Juris Doctor (J.D.) degree

- Regular one-year (minimum) postgraduate program leading to a Master of Laws (LL.M.) degree primarily for legal practitioners and jurists, prospective law teachers, as well as professional specialists

[ATTENTION]

[Please keep this hidden element and section here.]

[Some text/graphic elements below may appear with duplicates. Whenever necessary, please edit both and don’t delete either.]

JURIS DOCTOR (J.D.) PROGRAM

The Juris Doctor (J.D.) course entails a study of general principles and basic theories of law as an intellectual discipline, as well as a systematic and analytical examination of the specific codes and statutory enactments in force in the Philippines, together with interpretative court decisions and other pertinent materials. Closely studied are the civil law basis of most private laws of the country and the common law concept embodied in the public laws and derived particularly from Anglo-American jurisprudence.

A qualified applicant, who passes the Law Aptitude Examination (LAE), must undergo an interview. The LAE is usually administered in the 2nd week of February in seven (7) testing centers (UP Diliman, UP Baguio, UP Cebu, UP Visayas, UP Mindanao, Cagayan de Oro City, Naga City). Registration starts by November. Click here for more information.

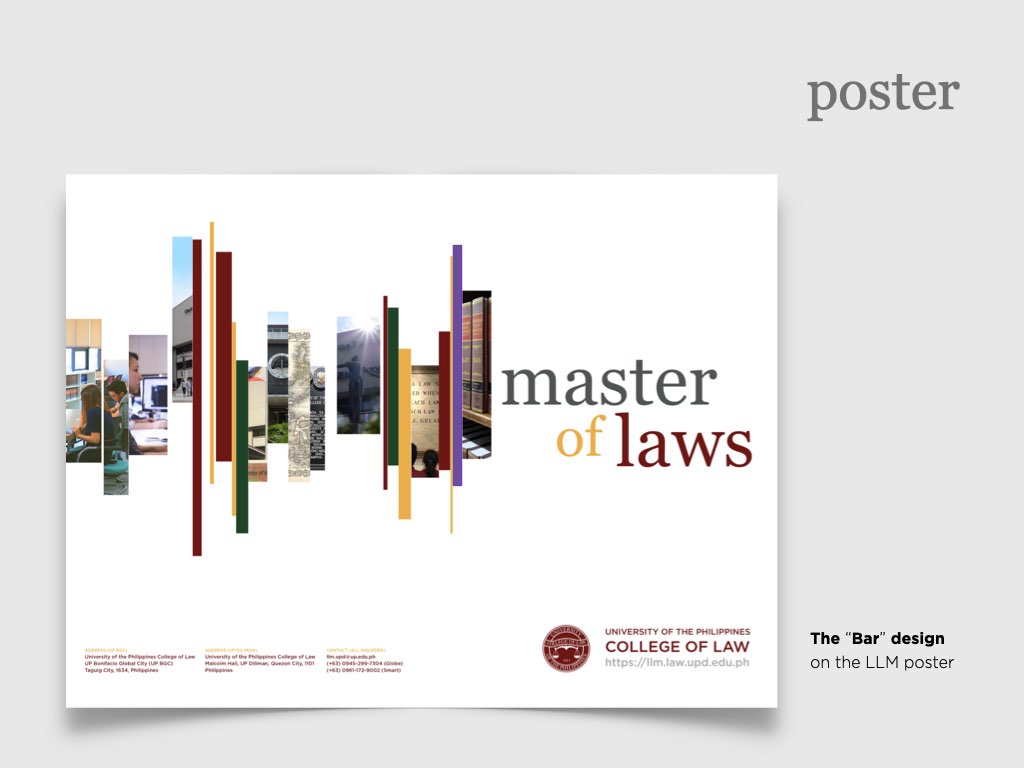

MASTER OF LAWS (LL.M.) PROGRAM

Our Master of Laws (LL.M.) program will introduce legal practitioners, law professors, judges, and government counsel to the intricacies of an evolving body of ASEAN regional law and its relationship with Southeast Asian (including Philippine) national laws. The Course provides adequate preparation for an increasingly cross-border regional hybrid legal system interacting with national judicial systems under the unique ASEAN Charter-based horizontal integration. Click here for more information.

ADMISSIONS FOR ACADEMIC YEAR 2021-2022 IS NOW OPEN. Visit the LL.M. Admissions Page for updates.

[ATTENTION]

[Please keep this hidden element and section here.]

[Some text/graphic elements below may appear with duplicates. Whenever necessary, please edit both and don’t delete either.]

UP LAW STUDENTS

The UP College of Law celebrates diversity among its students. The students come from various academic backgrounds—political science, economics, philosophy, chemistry, biology, geodetic engineering, and medicine, among others. For their extra-curricular activities, they can participate in inter-university debates and various international Moot Court competitions during the year. UP Law students have excelled in Philip C. Jessup International Law Moot Court Competition, Stetson International Environmental Law Moot Court Competition, Monroe E. Price Media Law Moot Court Competition, and Red Cross (Asia-Pacific) International Humanitarian Law Moot Court Competition.

What’s it like to study in UP Law? Hear it from our students.

UP LAW FACULTY

The UP Law Faculty is known for its expertise in the various fields of law and its members are recruited by invitation to teach in the College. Policymakers call on the Faculty regularly for its insights on pending legislation or to draft laws for congressional action. Members of the faculty litigate cases of national significance. They appear before the Supreme Court either as counsel for various parties or as amicus curiae. A former member of the College Faculty, Marvic M.V.F. Leonen, is now a sitting Justice of the present Supreme Court and Judge Raul Pangalangan served on the International Criminal Court. Both have also served as former Deans of the College. The Law Faculty is widely published in prestigious Philippine and international journals.

Know more about the UP Law Faculty members here.

UP LAW FACULTY

UP LAW ALUMNI

The UP College of Law Grand Alumni Homecoming is an annual event attended by hundreds of alumni in any given year—graduates who have, through the years, attained distinguished careers in government service, the judiciary, academe, and in private practice. The host class organizes several activities to be participated in by our law alumni and friends of the College. In addition to gathering together our alumni as part of the celebration, these activities serve as fundraiser to support the homecoming and our Alumni Association’s beneficiary: its alma mater.

Know more about the UP Law Alumni here.

The Law Aptitude Examination (LAE) consists of objective tests designed to measure certain abilities and skills necessary for the study of law. Applicants will be assessed for admissions on the basis of both the LAE results and their academic results.

The UP College of Law has already finalized the list of LAE qualifiers for the Academic Year 2021-2022. For announcements, updates, and more information on the LAE process, please visit the website: LAE.law.upd.edu.ph. Please also refer to our FAQs – frequently asked questions here. (Note: click here to view the final list of LAE passers for AY 2020-2021, the previous academic year.)

[ATTENTION]

[Please keep this hidden element and section here.]

[Some text/graphic elements below may appear with duplicates. Whenever necessary, please edit both and don’t delete either.]

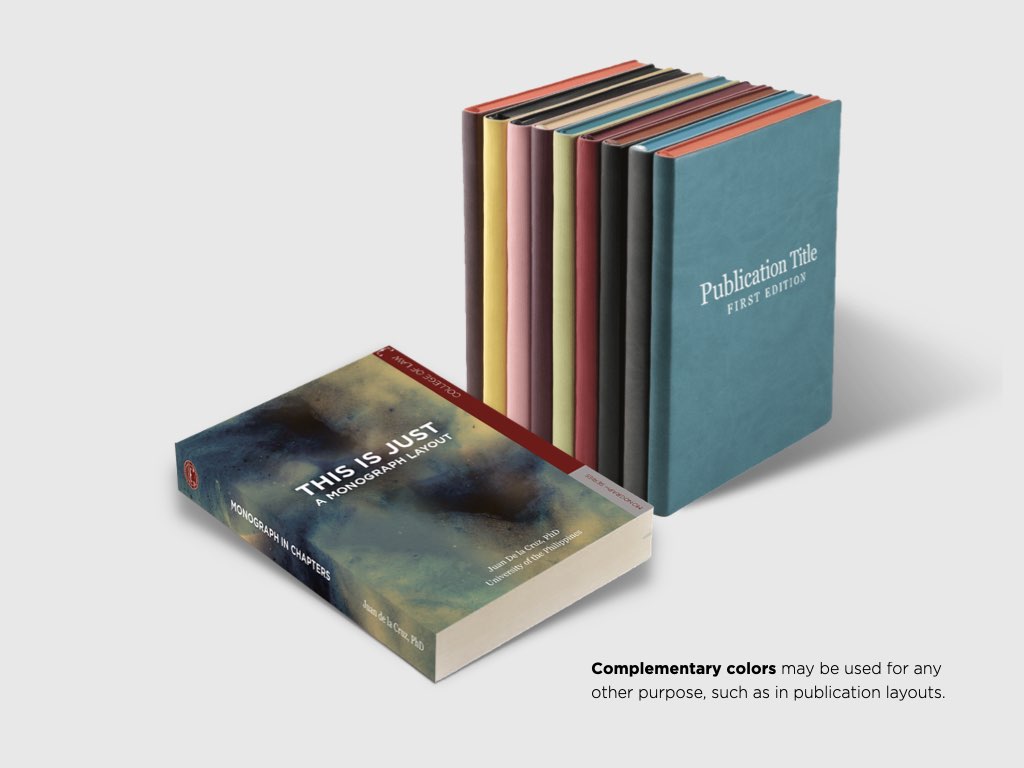

The UP Law Center, established by Republic Act 3870, has various programs that carry the law to the wider public in fulfilment of its mandate to raise the legal literacy level of Filipinos. Its Charter directs the institution:

- to undertake law institutes or study programs for continuing legal education (such as the MCLE, click here to know more);

- to undertake legal studies and researches on request from the various agencies of the government concerned with law reform, including the committees on Revision of Laws of the House of Representatives and the Senate; and

- to undertake the publication of studies, monographs, research papers, articles, and other works or writings on law, with special emphasis on those related to its general objectives, and to distribute them at cost to government agencies, judges, lawyers, government administrators and other interested parties

For more information, download the UP Law Center brochure hereor visit the UP Law Center website.

CONTACT INFO

Address (UP Diliman)

Malcolm Hall, Osmeña Avenue

University of the Philippines Diliman

Quezon City 1101 Philippines

Address (UP BGC)

University of the Philippines

Bonifacio Global City (UP BGC)

32nd/38th Street, Taguig City 1634

Philippines

PHONE (diliman CAMPUS)

(+632) 8 920 5514

PHONE (BGC CAMPUS)

(+63) 8 818 7242

Email (All inquiries)

ocs_law.upd@up.edu.ph

ocs_law.upbgc@up.edu.ph

llm.upd@up.edu.ph (for LL.M. only)

ISO 9001:2015

The UP Law Complex operates a management system that conforms to the standards of ISO. Use the QR code to view the certification. Tap or hover on this box to know more.

_What is an ISO certification?

ISO Standards are internationally agreed by experts. It is the world's best-known quality management standard for companies and organizations of any size.

Receive Updates

ISO 9001:2015

The UP Law Complex operates a management system that conforms to the standards of ISO. Use the QR code to view the certification. Tap or hover on this box to know more.

_What is an ISO certification?

ISO Standards are internationally agreed by experts. It is the world's best-known quality management standard for companies and organizations of any size.

on the upper right corner to select a video.

on the upper right corner to select a video.